Child tax credit has seen several temporary changes recently, and a significant agreement was announced on January 16th by Senate Finance Committee Chair Ron Wyden and House Ways and Means Chair Jason Smith regarding potential changes to the Child Tax Credit.

Legislative Developments

On January 17th, a legislative text was released, followed by a mark-up in the Ways and Means Committee on January 19th, where the bill was amended and voted favorably with a 40-3 vote, shedding light on proposed alterations to the Child Tax Credit in H.R. 7024.

Overview of Child Tax Credit

The Child Tax Credit, under permanent law, allows eligible households to reduce their income tax liability by nearly $1000 for each child aged 16 or below, with low-income taxpayers benefiting from the refundable portion of the credit, known as the Additional Child Tax Credit (ACTC).

Previous Legislative Changes

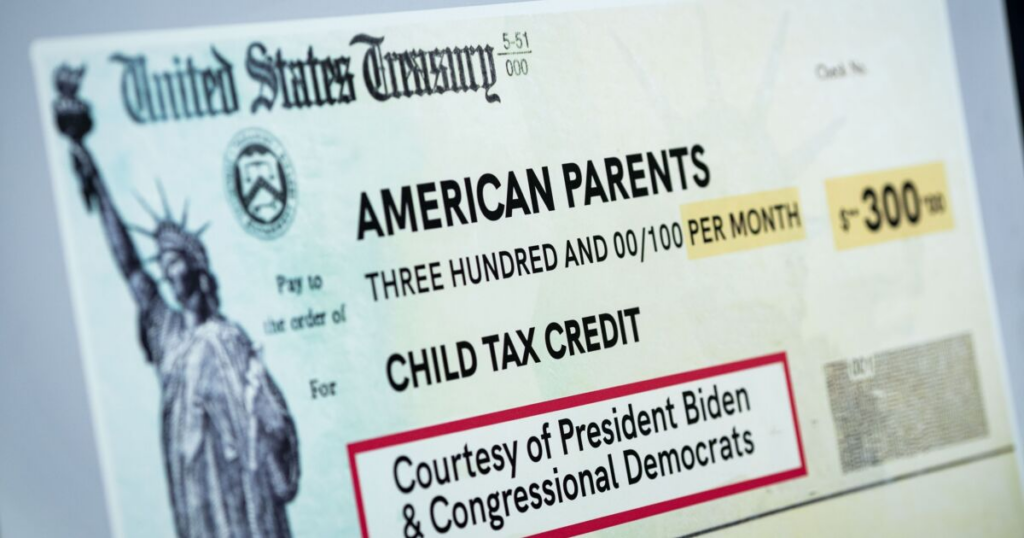

The Tax Cuts and Jobs Act (TCJA); P.L. 115-97, temporarily modified the permanent credit until 2025 by raising the maximum credit amount to USD 200 per child, among other adjustments. The American Rescue Plan Act of 2021 further augmented the credit, which expired at the end of 2021.

Policy Impact and Proposed Changes

The expansion of the credit has garnered attention from policy makers, leading to various proposals for modifying the Child Tax Credit, and research indicates that extending or making the credit permanent would have a relatively modest impact on employment, sparking concerns about the potential impact on employment and leading to a focus on expanding the credit for lower-income households.

Provisions in H.R. 7024

H.R. 7024 encompasses provisions aimed at expanding the Child Tax Credit for households with lower income, including the calculation of ACTC for every child, an increase in the maximum Additional Child Tax Credit, and the use of prior year income earned for calculating ACTC.

The proposed changes to the Child Tax Credit for 2024 aim to provide greater financial support to lower-income families and alleviate the economic burden, ultimately contributing to a more inclusive and supportive social framework.

FAQs

What are the key changes proposed in H.R. 7024?

The key changes proposed in H.R. 7024 include the calculation of ACTC for every child, an increase in the maximum Additional Child Tax Credit, and the use of prior year income earned for calculating ACTC.

What is the purpose of the proposed modifications to the Child Tax Credit?

The purpose of the proposed modifications is to provide greater financial support to lower-income families and alleviate the economic burden, contributing to a more inclusive and supportive social framework.

How did the American Rescue Plan Act of 2021 impact the Child Tax Credit?

The American Rescue Plan Act of 2021 augmented the credit by increasing the amount per child and expanding the age of eligibility, which expired at the end of 2021.